AI in M&A: Three Key Use Cases and Driving Adoption with Change Fluency

Artificial intelligence (AI) is transforming how mergers and acquisitions (M&A) are executed—from strategy and target sourcing to due diligence. AI tools boost efficiency, uncover insights human teams might miss, and enable faster, data-driven decisions. Companies can now review thousands of documents in a fraction of the time and identify hidden risks more effectively. Below, we explore three key use cases of AI in the M&A process—and, critically, how to drive adoption using a Change Fluency™ approach focused on behavioral change.

1. AI for M&A Strategy and Market Intelligence

AI empowers deal strategists with deeper market intelligence and predictive analytics at the strategy formulation stage. Instead of relying solely on manual research, teams can leverage AI-driven platforms to scan vast market data and trends in seconds.These tools help identify emerging industry shifts, competitive moves, and potential acquisition areas that align with the company's strategic goals.

AI algorithms can quickly scan financial and market data to identify companies that match key criteria like revenue growth, margins, or tech focus. Natural Language Processing (NLP) tools monitor news and social media for signals—such as leadership changes or product issues—that may indicate acquisition readiness. AI even helps analyze qualitative factors like corporate culture or customer sentiment to flag integration risks early, ensuring better strategic compatibility in deals [1] dealroom.net.

AI also enables data-driven strategy planning. It can forecast market scenarios and model deal outcomes under various assumptions, improving the accuracy of valuations and synergy estimates. Unlike traditional spreadsheets, AI-driven models consider a wider range of variables, giving corporate development teams more confidence in fine-tuning their M&A strategy. [2] imaa-institute.org.

AI-driven research platforms offer features like automatic summarization of key information from financial and market documents. By aggregating and analyzing millions of data points, strategists can quickly grasp trends and insights for informed decision-making.

AI’s impact on strategy is ultimately about making better decisions faster. It augments human analysts by crunching the numbers and reading the news at a scale impossible for individuals, surfacing key insights instantly. This allows M&A leaders to focus on high-level judgment calls – like which markets to expand into or which capabilities to acquire – with AI providing a rich, data-driven foundation for those decisions [3] grata.com.

Early adopters of AI in M&A strategy report enhanced efficiency, risk mitigation, and even the discovery of new deal opportunities that might have been overlooked [2] imaa-institute.org.

2. AI for Deal Sourcing and Target Identification

Finding the right acquisition targets is often like searching for a needle in a haystack, this is where AI truly shines. AI-powered deal sourcing tools can rapidly scan through countless companies (including private firms) to build a robust pipeline of prospects. Machine learning algorithms analyze factors such as financial health, market position, growth potential, and even web presence to identify high-potential targets that fit the buyer’s criteria.

These systems don't just run one-time searches; some deal teams employ continuous AI screening that monitors the market 24/7 for any company meeting certain triggers (revenue milestones, patent filings, venture funding, etc.). This proactive approach, often termed programmatic M&A, ensures you’re ready to pounce on opportunities as they emerge, rather than sourcing deals reactively [2] imaa-institute.org.

AI also enables more intelligent filtering and prioritization of targets. Traditional methods might rely on industry codes or personal networks; AI tools instead parse business descriptions and behaviors. For instance, dealmakers can use natural language queries to find companies that "provide B2B software for supply chain optimization" or "specialist manufacturers in electric vehicle components," even if those companies aren’t obvious from standard industry classifications.

One example is the platform Grata, whose AI-driven search allows users to discover private companies by keywords and filter by criteria like location, ownership, growth, or funding in order to surface hidden gems that match their strategy. These platforms can even suggest look-alike companies – if one startup in your portfolio was a great success, AI can find similar profiles that might be your next acquisition target [3] grata.com.

Furthermore, AI helps interpret subtle deal signals in the market. NLP algorithms can track press releases, earnings calls, and social media for hints that a company might be exploring a sale or facing headwinds. An uptick in negative sentiment or regulatory issues in news about a company, for instance, could indicate an openness to acquisition that savvy buyers might exploit [1] dealroom.net.

By casting a wider and smarter net, AI-driven sourcing tools ensure M&A teams don’t miss out on viable targets due to information overload. In short, AI amplifies origination efforts – automating the low-value research grunt work and allowing deal professionals to focus on building relationships and evaluating the most promising leads.

To illustrate, here are a couple of prominent AI tools in deal sourcing:

Grata – an AI-powered company search engine that maps the universe of private companies, allowing users to search by business descriptions and get curated lists of niche players (e.g. all “mid-size IoT cybersecurity firms in Europe”). It also flags M&A signals like recent executive hires or funding events that could indicate a company is in play.

DealCloud (Intapp) – a CRM and pipeline management platform with AI capabilities that surface connections between companies and people. It can highlight relationship paths to a target (who at your firm knows someone on the inside) and suggest next steps, making outreach more effective.

By leveraging such tools, M&A advisors and corporate development teams can significantly expand their funnel without proportionally expanding their effort, leading to more proprietary deals and better chances of finding the perfect acquisition candidate [2] imaa-institute.org.

3. AI for Due Diligence and Data Room Efficiency

Perhaps the most game-changing impact of AI in M&A is in due diligence, traditionally the most labor-intensive phase. AI-driven software can read and analyze documents at superhuman speed, automating tasks that used to bog down deal teams for weeks. This includes reviewing contracts, financial statements, compliance documents, and more.

Advanced NLP models can examine thousands of pages of legal documents or contracts in hours rather than weeks, flagging important clauses and inconsistencies automatically [6] grata.com. One due diligence lawyer described this shift succinctly: AI does the heavy lifting of combing through mountains of text, so humans can focus on the tricky nuances and deal-critical judgments.

A prime use case is contract analysis. AI contract review tools (like Kira, Luminance, or LEGALFLY) are trained on legal language to identify key provisions and anomalies across large contract sets. They can instantly pull out clauses like change-of-control, assignment, indemnities, or GDPR language from every contract in a data room, highlighting which agreements deviate from standards or pose risks. This not only accelerates the legal review but also reduces the risk of human error – the AI won't "get tired" and skip over a critical detail at 2 AM.

As an example, Fenwick & West LLP reported that using Kira’s AI to review M&A contracts enabled faster and more complete analysis, allowing their attorneys to focus on nuanced issues while the AI handled routine extraction and summary of terms [5] fenwick.com.

Overall, AI streamlines the due diligence process by rapidly surfacing red flags (like pending litigation, unusual earn-out clauses, or undisclosed liabilities) that would otherwise require tedious manual digging [7] imaa-institute.org.

AI tools can automate tasks like document redaction in a virtual data room. AI-assisted redaction quickly combs through thousands of pages to hide sensitive personal or financial information, saving deal teams countless hours of manual work.

AI is streamlining virtual data rooms for both buyers and sellers. Smart platforms now feature auto-categorization, semantic search, and anomaly detection. Instead of analysts manually sorting PDFs, AI organizes documents, suggests tags, and flags missing or misfiled files. Due diligence questions that once required hours of searching can now be answered in seconds with a simple query—e.g., “Show all contracts with a change of control clause.”

Additionally, AI-driven analytics track buyer behavior in the data room (which pages are most viewed, which sections prompt repeated downloads) to alert sellers on potential areas of concern or negotiation focus.

Automated redaction is another major breakthrough. AI tools can quickly scan thousands of pages and accurately redact sensitive data—like names, SSNs, or trade secrets—saving time and reducing risk. In fast-moving deals, this can shave off hours or days in preparing a clean data room. According to SS&C Intralinks, incorporating AI redaction in their deal platform has significantly accelerated due diligence cycles and freed up team members to focus on higher-value analysis instead of tedious scrubbing of documents [4] intralinks.com.

Overall, by automating routine due diligence work, AI allows deal teams to concentrate on big-picture evaluation: thinking through strategic fit and integration challenges, rather than sifting pages for the 15th assignment clause. Studies have found that AI tools can reduce the time spent on due diligence by 50% or more while improving accuracy, as the technology catches details a human might miss in a rushed review [1] dealroom.net. In practice, this means faster deal timelines and fewer surprises post-close.

Driving Adoption: Change Fluency as the Enabler

All of these AI capabilities sound great – but they only deliver value if teams actually use them. In many organizations, adopting new technology is as much a people challenge as a tech challenge.

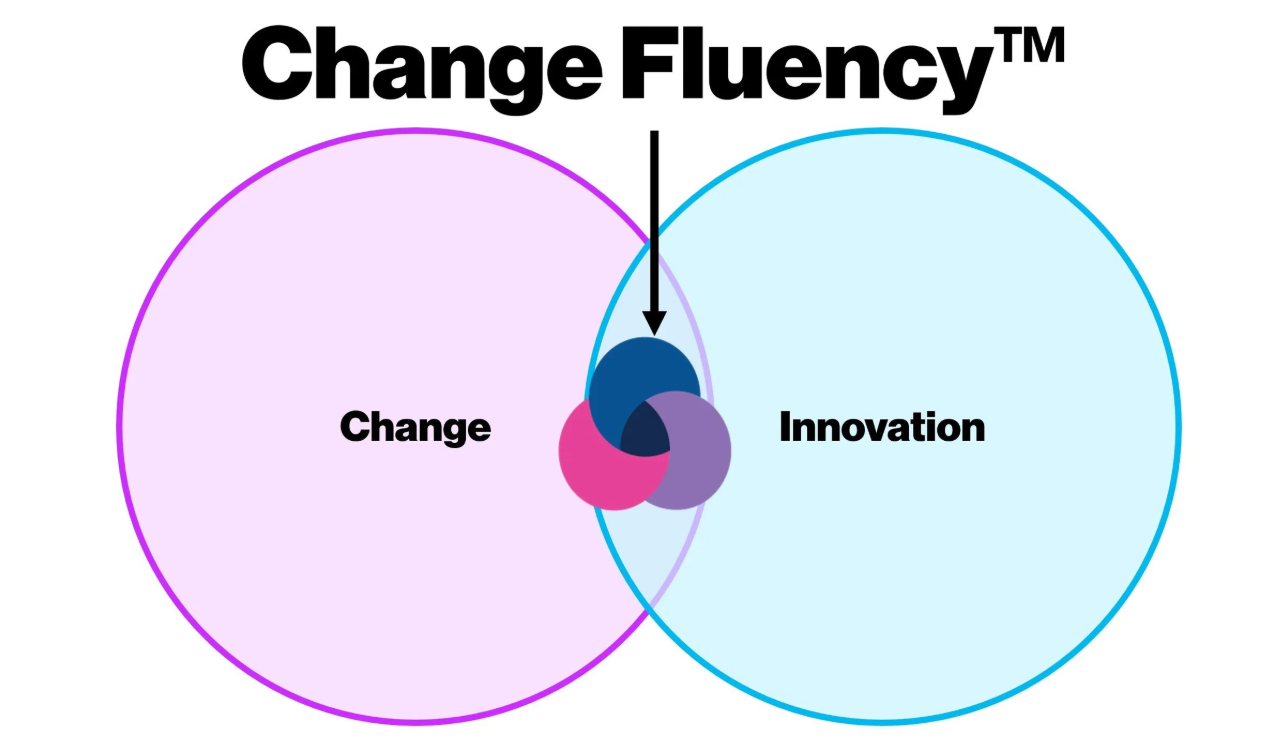

This is where the Change Fluency model comes in—helping teams build the mindset and behaviors needed to turn AI from hype into everyday practice.

Implementing AI in M&A often requires behavior shifts—like analysts trusting AI summaries, lawyers using AI-generated risk reports, or deal teams regularly checking sourcing dashboards. Resistance usually stems from fear, lack of confidence, or ingrained habits. A Change Fluency approach addresses this by focusing on enablement and cultural buy-in, ensuring teams are upskilled and processes refined alongside tool deployment.

Education and Upskilling: Teams need to understand how the AI tools work and how to interpret their outputs. Providing hands-on training sessions and pilot projects builds confidence. When professionals see for themselves that an AI tool can accurately flag a contract risk or find a great target, they become more likely to trust and use it regularly.

Integrated Workflows: Change Fluency stresses integrating AI into existing workflows in a seamless way. Rather than running AI tools in isolation, incorporate them into the standard deal checklist. For example, make the AI document review a mandatory step that occurs alongside human review, so it’s viewed as part of the process (not a gimmick). This normalizes the technology’s role.

Leadership and Incentives: Leaders and deal managers should champion the use of AI by setting expectations and leading by example. If senior advisors show in meetings how they used an AI insight to make a decision, it sends a powerful message. Additionally, recognizing and rewarding team members who find clever ways to leverage AI can reinforce adoption.

The core idea of Change Fluency™ is that organizations gain traction with AI not just by choosing the right tools, but by nurturing the behaviors and mindset to use those tools effectively. It’s about developing what some call AI fluency – the ability of your people to work alongside AI comfortably and creatively.

That means addressing any fears (like “Will AI replace my judgment?”) through open dialogue and demonstrating that AI is there to augment their expertise, not replace it. It also means setting up continuous learning, so teams can keep up with evolving AI features and best practices.

An example of this is creating an internal community of practice for M&A AI where team members share tips and use cases that can accelerate collective learning.

In practice, firms that apply a Change Fluency lens see much higher adoption rates of new tech. Instead of an AI tool gathering dust after an initial trial, it becomes a standard, even beloved, part of the workflow. Behavioral change is the secret sauce – when your team actively embraces AI as a helper, the benefits (speed, accuracy, deeper insight) multiply across all your deals.

Sources:

1. Rao, Supritha S. "Examples of AI in M&A: Key Applications Transforming Deal Processes." DealRoom (2023) dealroom.net

2. Noghrehkar, Nima. "AI and the Future of Mergers and Acquisitions." IMAA Institute (2024) imaa-institute.orgimaa-institute.org

3. Grata. "How to Identify and Evaluate M&A Targets." Grata Blog (2025) grata.com

4. Gatmaitan, Patricia. "AI Redaction Can Make or Break a Deal." SS&C Intralinks Blog (2023) intralinks.com

5. Fenwick & West LLP. "Fenwick Leverages Kira Systems’ AI Platform to Help Clients Efficiently Navigate M&A Due Diligence." (Press Release, 2016) fenwick.com

6. Grata. “How AI is Revolutionizing M&A: Key Insights and Future Trends”. Grata Blog (2023) grata.com

7. IMAA Institute. "Best AI Tools for M&A Due Diligence". (2024) imaa-institute.org